CA FL-303 2020-2024 free printable template

Show details

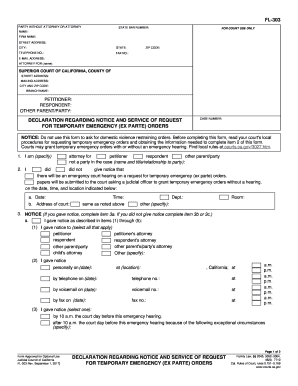

FL303

PARTY WITHOUT ATTORNEY OR ATTORNEYSTATE BAR NUMBER:FOR COURT USE ONLINE:

FIRM NAME:

STREET ADDRESS:

CITY:STATE:TELEPHONE NO.:FAX NO.:ZIP CODE:EMAIL ADDRESS:

ATTORNEY FOR (name):SUPERIOR COURT

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your california declaration notice 2020-2024 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your california declaration notice 2020-2024 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing california declaration notice online

Follow the guidelines below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit fl 303 form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

CA FL-303 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out california declaration notice 2020-2024

How to fill out California declaration notice:

01

Obtain the correct form: You will need to download or obtain the California declaration notice form. It is important to make sure you have the latest version of the form to ensure accuracy.

02

Fill in personal information: Begin by filling out your personal details such as your name, address, phone number, and any other requested contact information. Make sure to double-check the accuracy of this information.

03

State the purpose of the declaration: Clearly indicate the reason for the declaration notice. This could be a legal matter, a change in financial circumstances, or any other relevant situation that requires formal documentation.

04

Provide a detailed description: Explain the circumstances or events that led to the need for the declaration notice. Be concise and specific, including dates and any relevant facts or details.

05

Sign and date: Once the form is complete, read through it thoroughly to ensure accuracy and clarity. Then, sign and date the document to indicate that the information provided is true and correct to the best of your knowledge.

Who needs California declaration notice:

01

Individuals involved in legal proceedings: If you are part of a court case or legal dispute in California, you may need to file a declaration notice to provide a detailed account of the facts or circumstances related to the case.

02

Those experiencing a change in financial circumstances: If you are experiencing financial changes such as a change in income, assets, or debts, you may need to file a California declaration notice to officially document these changes.

03

People involved in certain administrative processes: Some administrative processes, such as applying for certain licenses or permits, may require individuals to submit a declaration notice to provide specific information or attest to certain facts.

It is important to note that the specific requirements for filing a California declaration notice may vary depending on the situation and the purpose of the notice. It is advisable to consult with an attorney or seek legal advice to ensure compliance with the appropriate procedures and regulations.

Fill fl 303 instructions : Try Risk Free

People Also Ask about california declaration notice

How do I draft a declaration in California?

What is an example of a legal declaration?

What is a California declaration?

How do you write a proper declaration?

What is a declaration of notice?

How do I write a declaration letter to court?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is the purpose of california declaration notice?

The California Declaration Notice is a form issued by the California Department of Industrial Relations that informs employees of their rights and responsibilities under the state's labor laws. The form is intended to help employers comply with the California Labor Code and the California Administrative Code. It is also meant to provide employees with information about their rights and protections in the workplace.

When is the deadline to file california declaration notice in 2023?

The deadline to file the California Declaration Notice in 2023 is June 30, 2023.

What is california declaration notice?

The California Declaration Notice refers to a legal document that must be given to tenants by landlords in the state of California. It notifies tenants that the property they are renting is in foreclosure and advises them of their rights and responsibilities during the foreclosure process. The notice is required by California law to be provided to tenants within five business days of the landlord receiving a notice of default or filing a notice of trustee's sale. The purpose of the California Declaration Notice is to ensure that tenants are informed about their rights and options as well as to minimize any potential disruption to their tenancy during the foreclosure process.

Who is required to file california declaration notice?

The California Declaration of Notice must be filed by the trustee or successor trustee of a revocable trust within 60 days after the settlor's death. Additionally, if the settlor of the trust was subject to California state law at the time of their death, the declaration notice must be filed with the Superior Court in the county where the settlor resided.

How to fill out california declaration notice?

To fill out the California Declaration Notice, follow these steps:

1. Download the California Declaration Notice form from the website of the California courts or obtain a paper copy from the court clerk's office.

2. Read the instructions provided on the form carefully to understand the purpose and process of completing the notice.

3. Start by providing your personal information in the designated fields. This typically includes your full legal name, contact address, phone number, and email address.

4. Identify the court information by entering the case number, county, and court location where your case is filed.

5. Declare the document(s) being served by selecting the appropriate box(es) that indicate the nature of the document(s) you are serving. For example, you may choose "Complaint" if you are serving a complaint in a civil case.

6. Indicate the parties involved in the case by entering their names, addresses, and relationship to the case (e.g., plaintiff, defendant, attorney).

7. Specify the method of service you plan to use for each party listed. You can choose between personal service, mail, electronic service, or publication.

8. If you have chosen personal service as the method, provide the name and address of the person responsible for the service.

9. Sign and date the declaration notice at the bottom of the form. Make sure to sign in the presence of a notary public or as otherwise required by the court.

10. Submit the completed declaration notice to the court clerk's office within the specified time frame as required by the rules of your particular case.

Note: It is recommended to consult the specific instructions provided by the California courts or seek legal advice if you have any doubts or questions regarding the completion of the California Declaration Notice form.

What information must be reported on california declaration notice?

The California Declaration Notice, also known as the Declaration of Compliance or Civil Case Cover Sheet, requires the reporting of the following information:

1. Case type: The specific type of case being filed, such as civil, family, probate, or small claims.

2. Case category: The broad category under which the case falls, such as personal injury, contract, landlord/tenant, or divorce.

3. Title of the case: A brief summary of the case's subject matter or the parties involved.

4. Case number: The unique identifier assigned to the case by the court.

5. Filing attorney or party's name: The name of the attorney or self-represented party filing the case.

6. Firm name (if applicable): The name of the law firm, if the filing party is an attorney.

7. Address: The mailing address of the filing attorney or party.

8. Telephone and fax numbers: Contact numbers for the filing attorney or party.

9. Email address (if applicable): The email address of the filing attorney or party.

10. Sponsoring attorney's name (if applicable): If the filing attorney is sponsored by another attorney or a law firm, their name must be provided.

11. State Bar number (if applicable): The registration number assigned to the filing attorney by the State Bar of California.

12. Party or parties represented: Identifying the names of all parties involved in the case, including any cross-complainants or cross-defendants.

13. Nature of the case: A brief description of the primary legal issues or claims involved in the case.

14. Appointment of a guardian ad litem (if applicable): The appointment of a legal representative for a minor or incapacitated party, if necessary.

It's important to note that the specific details required may vary depending on the court and the type of case being filed. It is always advisable to consult the court's guidelines or seek professional legal advice for accurate and complete documentation.

What is the penalty for the late filing of california declaration notice?

The penalty for the late filing of a California Declaration Notice can vary depending on the specific situation. Generally, if the Form 540 or 540NR tax return is filed and the declaration notice is not submitted with the return or is submitted late, a penalty of $50 to $500 may be assessed. The penalty amount can depend on various factors such as the taxpayer's history of compliance, the amount of tax owed, and the length of the delay in filing the declaration notice. It is advisable to consult with a tax professional or refer to the California Franchise Tax Board for more specific and up-to-date information regarding penalties for late filing.

Where do I find california declaration notice?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific fl 303 form and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I complete declaration notice service online?

pdfFiller has made it easy to fill out and sign fl 303 form. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I complete fl303 on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your declaration parte form by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

Fill out your california declaration notice 2020-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Declaration Notice Service is not the form you're looking for?Search for another form here.

Keywords relevant to declaration notice form

Related to ca fl 303 form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.